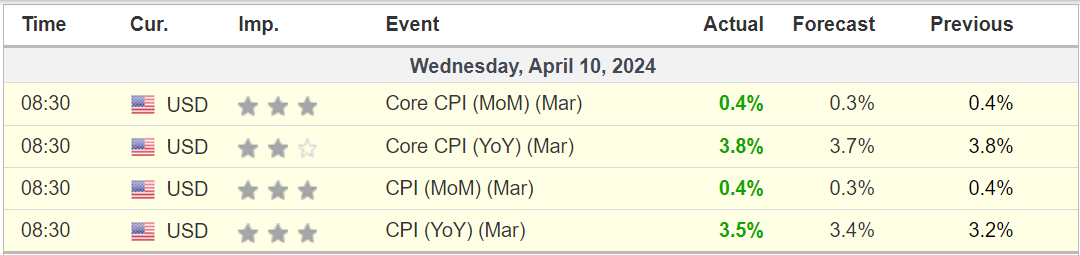

Wednesday’s much-anticipated U.S. (CPI) inflation report for March came in hotter than expected, providing further evidence that the Federal Reserve will be in no rush to start cutting interest rates anytime soon.

Source: Investing.com

The rose 0.4% last month, matching the largest monthly increase since September. In the 12 months through March, the annual increased 3.5%, above forecasts for 3.4%. That followed a gain of 3.2% in February.

Excluding the volatile food and energy components, climbed 0.4% over the prior month and over last year. The forecast had been for 0.3% and 3.7%, respectively.

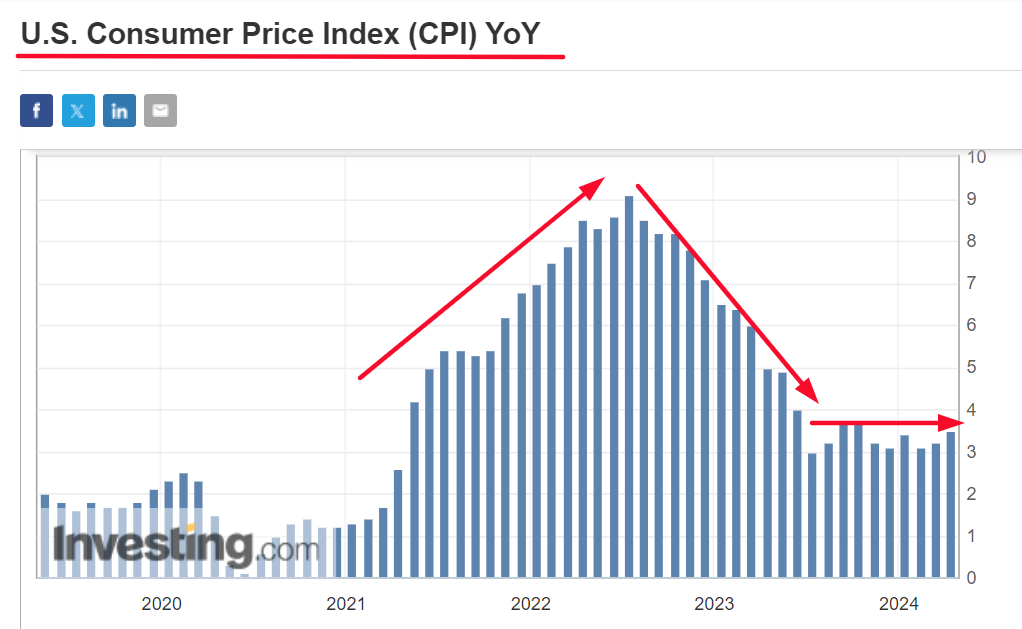

While headline CPI has come down significantly from a 40-year high of 9.1%, the data confirmed that the decline in inflation that began in the summer of 2022 has all but stalled.

Taking a closer look at the chart below reveals that the annual CPI rate has been stuck in a range between 3.0% and 3.8% for the past nine months, highlighting the challenge faced by the Fed in the ‘last mile’ of its fight against inflation.

Source: Investing.com

The ‘last mile’, which is often the hardest to bring under control, refers to the final 1% or 2% of excess inflation that the Fed needs to overcome to meet its 2% target.

Key Takeaway

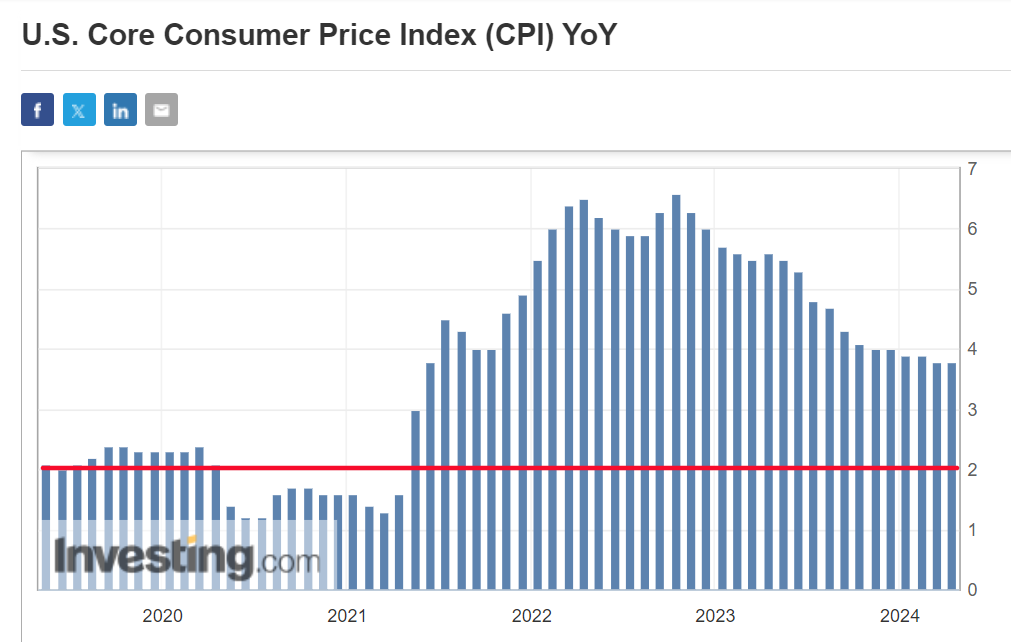

The Fed’s inflation battle is far from over.

U.S. CPI inflation is still rising far more quickly than what the Fed would consider consistent with its 2% target range.

Additionally, core inflation is proving stickier than expected and is anticipated to remain well above the Fed’s target for the foreseeable future.

Source: Investing.com

Furthermore, there is a growing risk that inflation might even go higher from here considering the recent spike in commodity prices.

Taking that into consideration, the U.S. central bank will be in no rush to lower its key Fed funds rate after another hot inflation report.

As such, I am sticking to my view that the Fed will not be cutting interest rates this year, with the first move now likely to only happen in Q1 2025.

What to Do Now Now

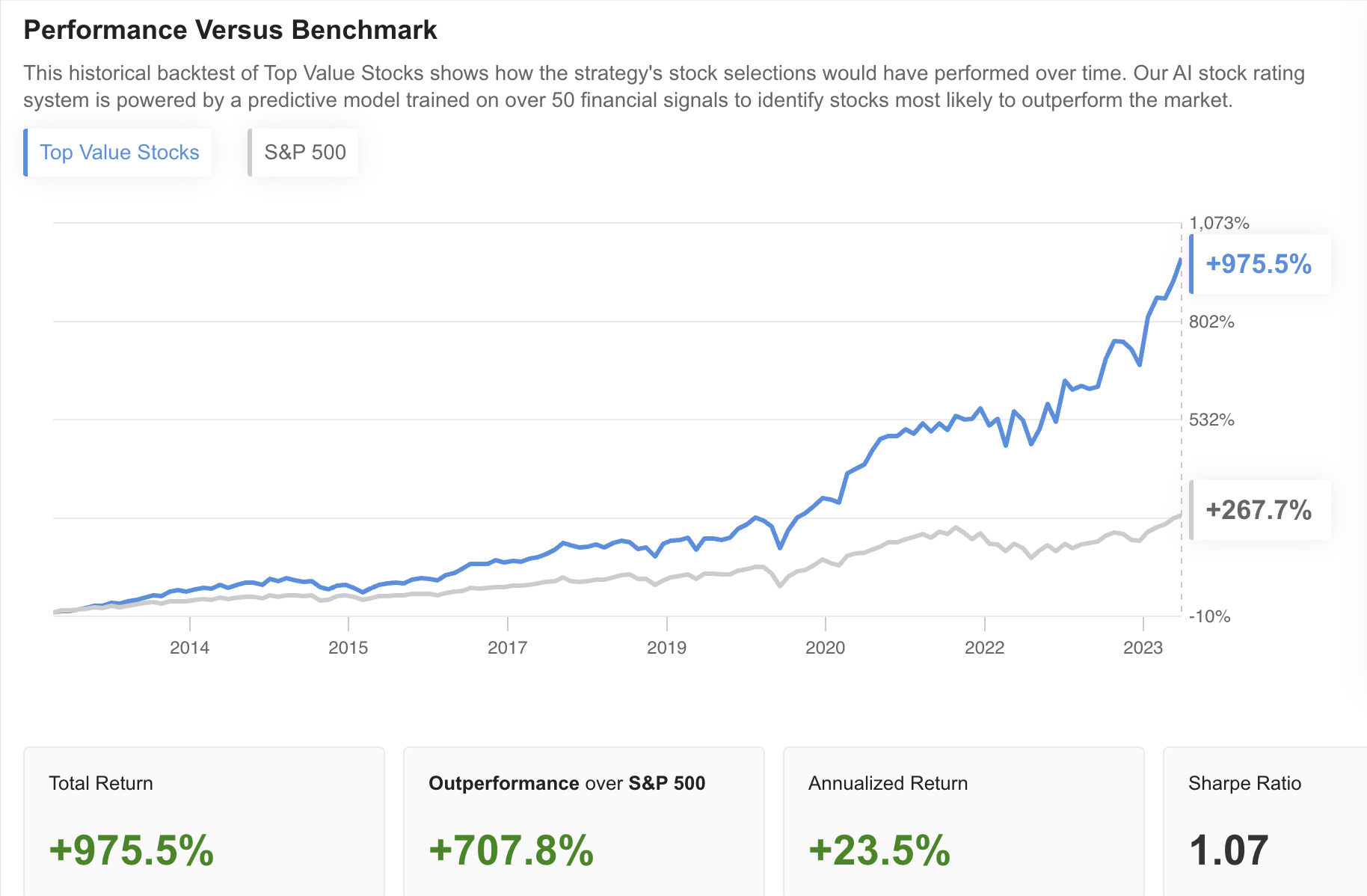

Did you know that your AI-powered stock-picking tool offers the best actively managed inflation-beating portfolios out there? For less than $9 a month with this link, you can safeguard your gains by following picks from our flagship strategy, Top Value Stocks, designed to provide you with a monthly selection of stable dividend-paying winners.

By focusing solely on companies with solid balance sheets, our strategy has beaten the S&P 500 over the last decade by an impressive 707%. And the best part? With much less risk.

Subscribe now for less than $9 a month and see all the stocks in our strategies for sustained market outperformance!

ProPicks is part of our premium InvestingPro feature, which also provides you with several other market beating tools, such as the InvestingPro screener.

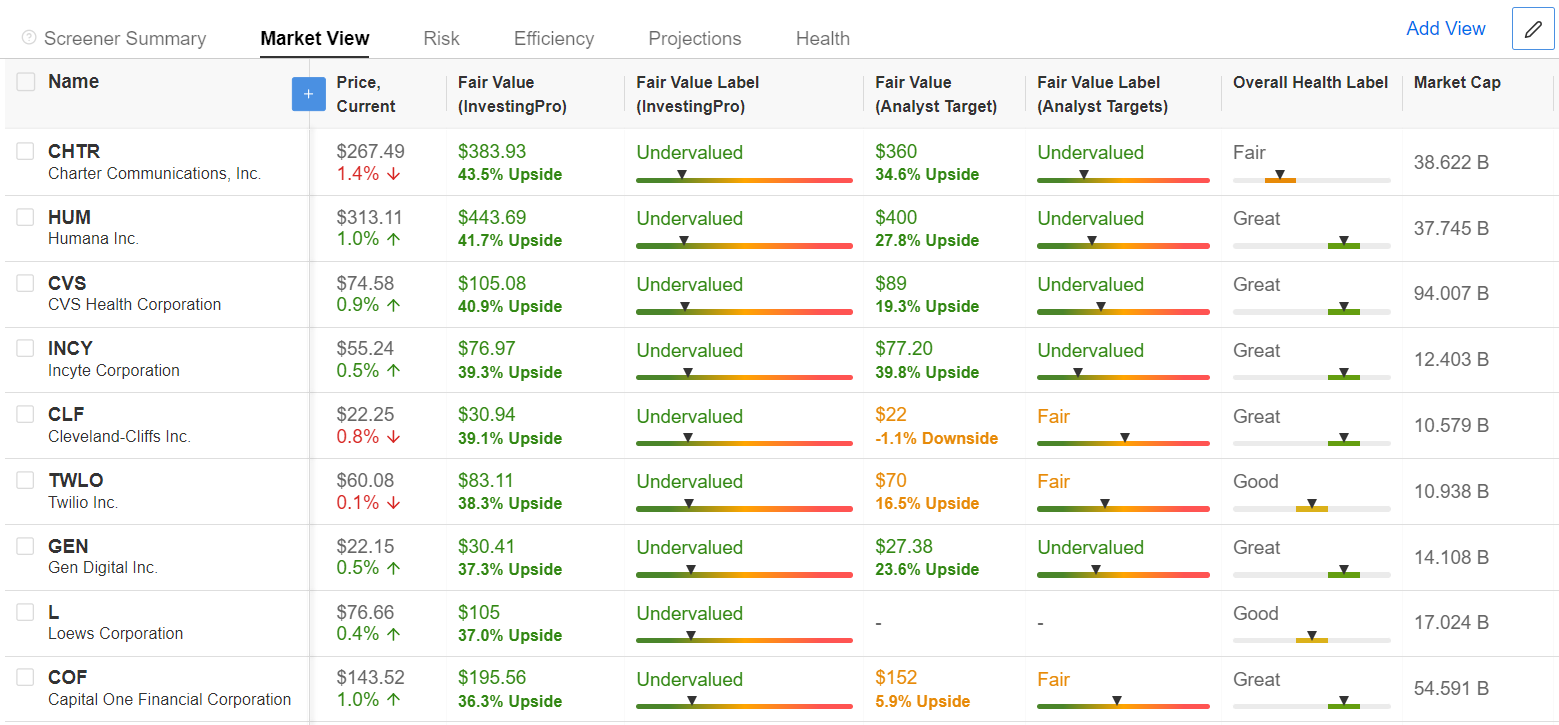

In fact, to help you successfully navigate through the uncertain macro backdrop, I used the InvestingPro screener to identify top-quality stocks with strong fundamentals and more upside ahead based on the Pro ‘Fair Value’ models.

My focus was on diversified companies that are defensive and demonstrate solid profitability, a healthy balance sheet, strong growth prospects, and resilient dividend payouts thanks to their market-leading position.

Here are the top ten stocks that could shape the investing landscape in the months ahead, based on the InvestingPro models.

Top 10 Stocks to Buy Now as Per InvestingPro:

- Charter Communications (NASDAQ:): InvestingPro Fair Value Upside: +43.5%

- Humana (NYSE:): InvestingPro Fair Value Upside: +41.7%

- CVS Health Corp (NYSE:): InvestingPro Fair Value Upside: +40.9%

- Incyte Corporation (NASDAQ:): InvestingPro Fair Value Upside: +39.3%

- Cleveland-Cliffs (NYSE:): InvestingPro Fair Value Upside: +39.1%

- Twilio (NYSE:): InvestingPro Fair Value Upside: +38.3%

- Gen Digital (NASDAQ:): InvestingPro Fair Value Upside: +37.3%

- Loews Corp (NYSE:): InvestingPro Fair Value Upside: +37%

- Capital One Financial Corporation (NYSE:): InvestingPro Fair Value Upside: +36.3%

- State Street (NYSE:): InvestingPro Fair Value Upside: +35.6%

Source: InvestingPro

With InvestingPro’s stock screener, investors can filter through a vast universe of stocks based on specific criteria and parameters to identify cheap stocks with strong potential upside.

InvestingPro empowers investors to make informed decisions by providing a comprehensive analysis of undervalued stocks with the potential for significant upside in the market.

Readers of this article enjoy an extra 10% discount on the yearly and bi-yearly plans with the coupon codes PROTIPS2024 (yearly) and PROTIPS20242 (bi-yearly).

Subscribe here and never miss a bull market again!

Disclosure: At the time of writing, I am long on the S&P 500, and the via the SPDR S&P 500 ETF (SPY), and the Invesco QQQ Trust ETF (QQQ). I am also long on the Technology Select Sector SPDR ETF (NYSE:).

I regularly rebalance my portfolio of individual stocks and ETFs based on ongoing risk assessment of both the macroeconomic environment and companies’ financials.

The views discussed in this article are solely the opinion of the author and should not be taken as investment advice.