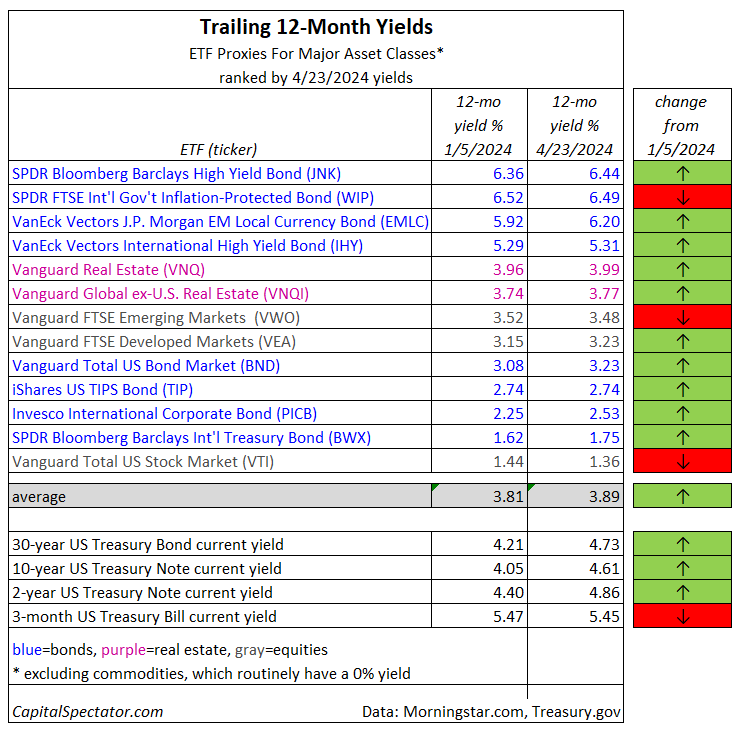

The average 12-month trailing yield for the major asset classes has ticked up so far this year, based on a set of proxy ETFs through yesterday’s close (Apr. 23) vs. early January. Relative to Treasury yields, however, government bonds continue to offer higher payouts.

The average trailing yield for risk assets is currently 3.89%, according to data from Morningstar.com. That’s slightly above the 3.81% mark when CapitalSpectator.com ran the numbers on Jan. 8.

Once again, investors can find substantially higher yields in US government securities. For example, a Treasury currently yields 4.61%, or 72 basis points above the average trailing payout for the major asset classes via the ETF proxies in the table below.

The highest-yielding risk asset is the High Yield Bond ETF (NYSE:), which generated a 6.44% yield over the past year. At the low end of the spectrum for the major asset classes: Vanguard Total Stock Market Index Fund ETF Shares (NYSE:) via a 1.36% yield.

Most of the ETFs in the table above posted higher trailing yields vs. the Jan. 8 profile. The four exceptions are foreign funds, which suffered, in part, due to a stronger US dollar year to date.

Keep in mind the standard caveats when evaluating the yields for the ETFs listed above. First, the trailing payout rates may or may not prevail. Unlike the opportunity to lock in current yields via government bonds, historical payout rates for risk assets by way of ETFs can be misleading in real time, due to changing payout amounts through time.

remove ads

.

Consider the ever-present possibility that whatever you earn in yields via ETF funds could be wiped out, and more, with lower share prices. That’s a reason also to consider total return expectations when looking for yield opportunities. For perspective on ex-ante performance, you can start with the monthly updates of CapitalSpectator.com’s long-term outlook for the major asset classes.