-

CrowdStrike’s Q4 earnings, due after market close, may reveal a robust outlook given its cloud-based cybersecurity solutions and recent customer growth.

-

As artificial intelligence shapes the tech landscape, CrowdStrike’s role in cybersecurity takes center stage, raising expectations about leveraging AI similar to successful tech companies like Nvidia.

-

A closer look at CrowdStrike’s Q4 expectations on InvestingPro indicates positive projections with anticipated revenues of $840 million, building on the company’s impressive 149% return in the past year.

- In 2024, invest like the big funds from the comfort of your home with our AI-powered ProPicks stock selection tool. Learn more here>>

CrowdStrike (NASDAQ:) is set to reveal its Q4 earnings today after the market closes. The cloud-based cybersecurity company is looking to paint a robust picture for the last quarter of 2023 based on customer growth and various new deals.

The report comes at a time when the rapid advancement of artificial intelligence has propelled tech companies like Nvidia Corporation (NASDAQ:) to significant heights, and cybersecurity has never been more crucial.

With the rise of malicious actors exploiting evolving technology, companies providing cybersecurity solutions, such as CrowdStrike, have taken center stage. This begs the question of whether CrowdStrike, like Nvidia, will leverage artificial intelligence.

As we anticipate healthy Q4 results for CrowdStrike, InvestingPro’s powerful tools can help us gain insights. This allows us to assess potential opportunities and speculate on the company’s trajectory in 2024.

CrowdStrike delivered a return of 149% over the past year. You can identify similar stocks early on using InvestingPro. Subscribe now and never miss out again!

Let’s delve into the expectations for the company’s last quarter results using the InvestingPro platform.

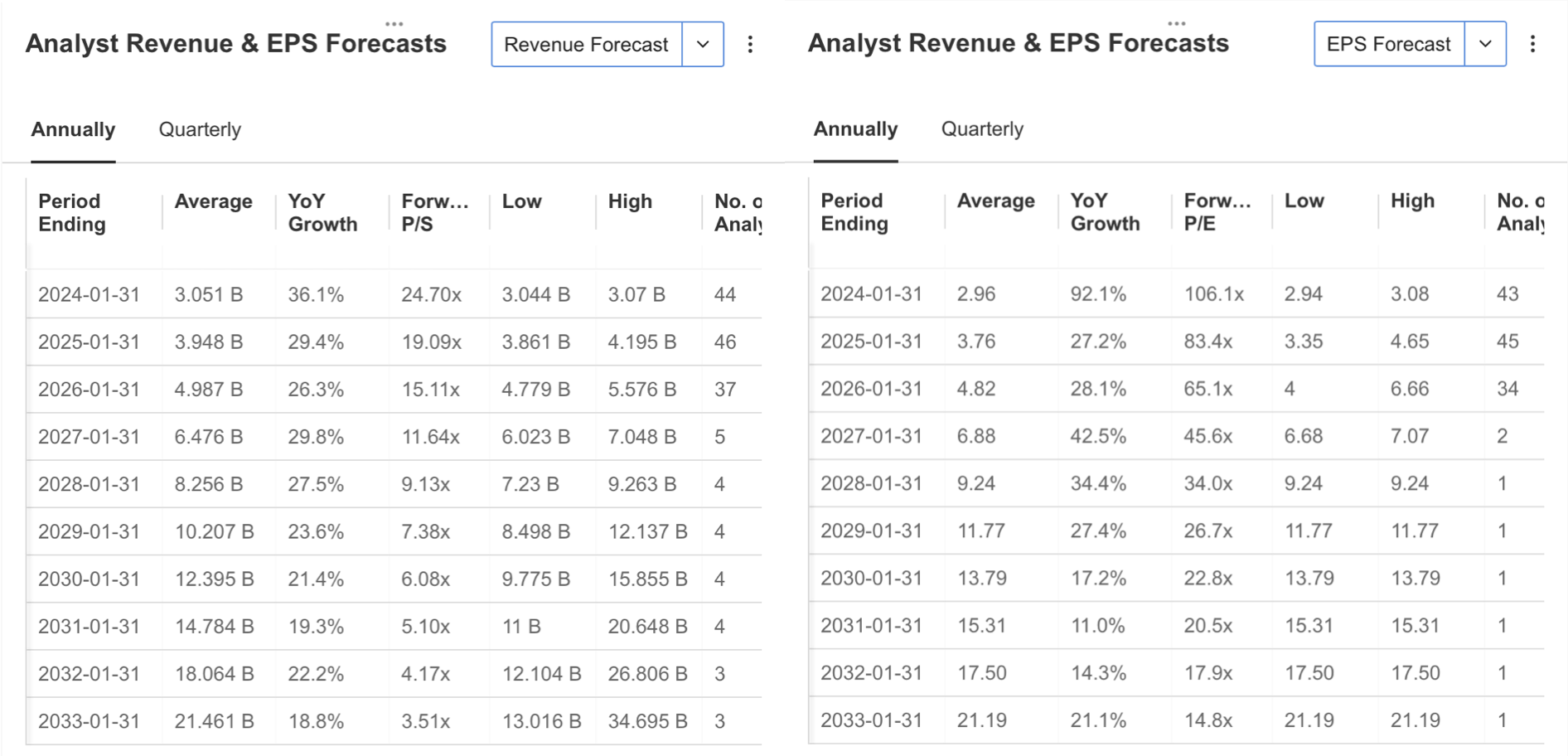

Source: InvestingPro

CrowdStrike is expected to announce revenues of $840 million in the last quarter. Accordingly, the EPS expectation is $0.82.

While analysts have revised their expectations upwards in the last 3 months, investors reacted positively to the 2nd and 3rd quarter results of the company, which managed to increase its revenue and EPS above expectations throughout the year.

Source: InvestingPro

For the whole of 2024, analysts expect the company to increase its revenue by more than 25% annually in the coming years, while analysts expect revenue of $3.05 billion, up 36%. In earnings per share estimates, there is an expectation of a significant increase of 92% this year, while CrowdStrike is expected to remain more moderate on an EPS basis for the next two years.

Source: InvestingPro

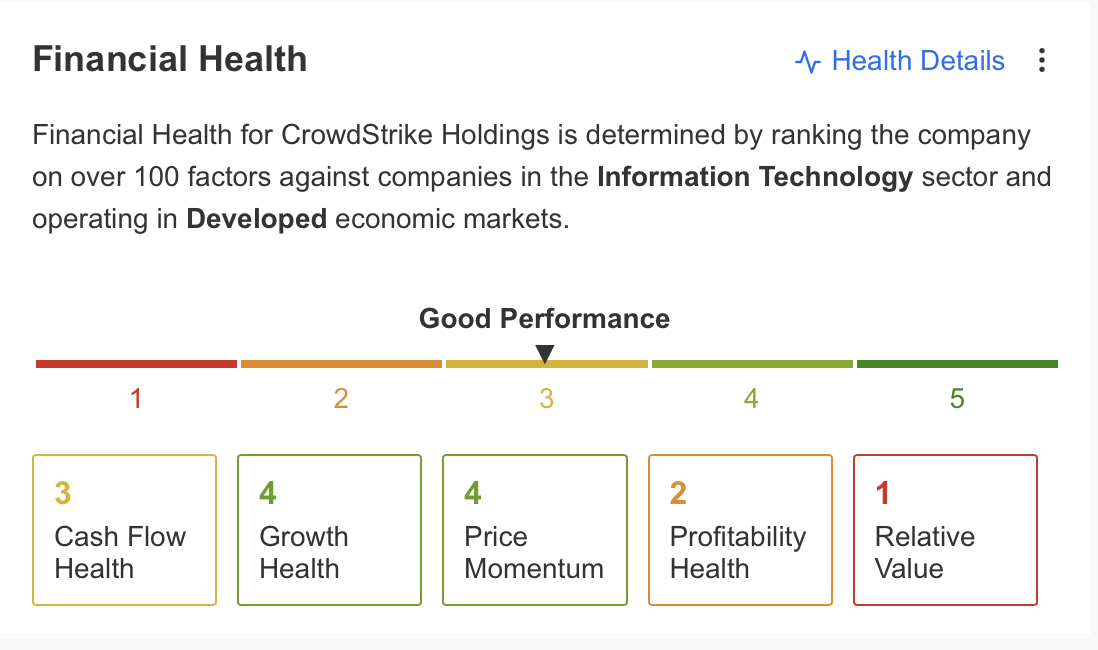

Financial Health: How Does CrowdStrike Fare?

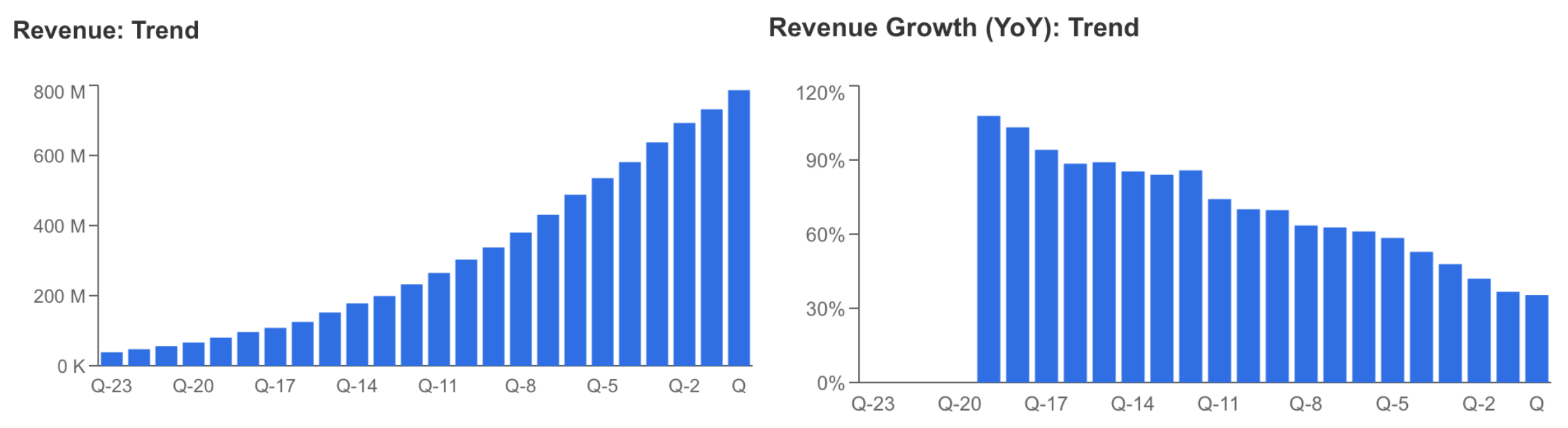

When we check the trend of CrowdStrike’s key financial items, a downward momentum in revenue growth is noteworthy despite the quarterly increase in revenue.

Source: InvestingPro

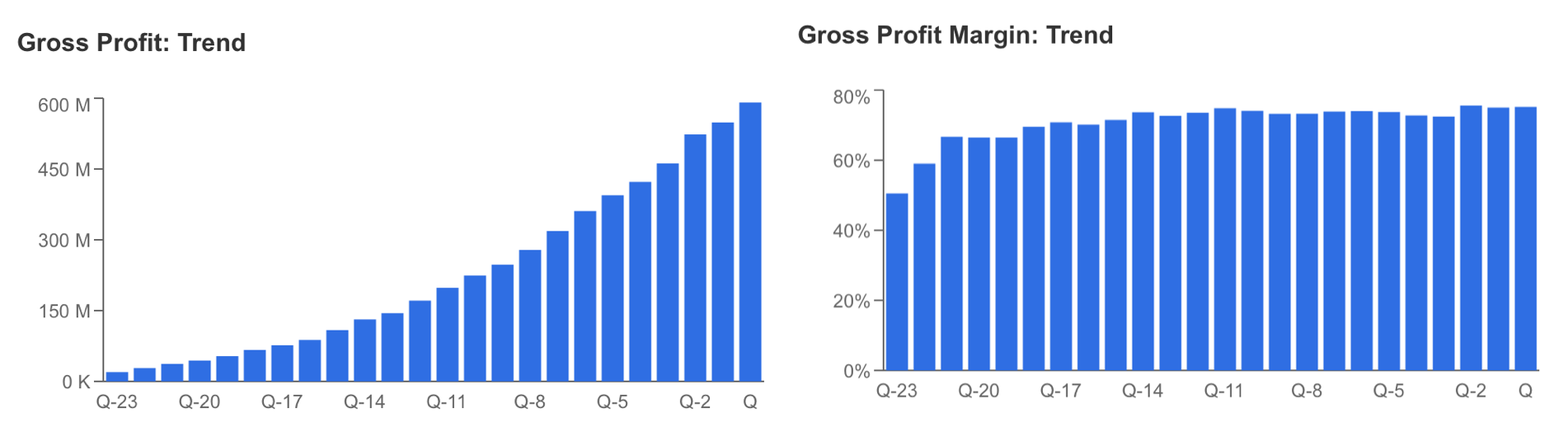

In addition, while the company manages to keep the increase in the cost of revenue more limited, the company continues to maintain its upward trend in gross profit with the gross profit margin maintained at 75%.

Source: InvestingPro

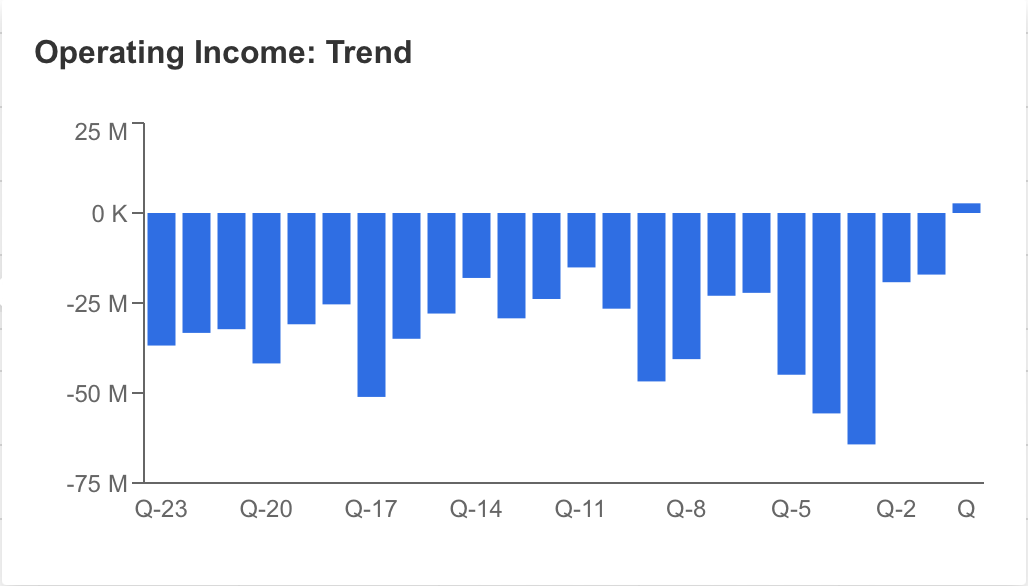

In Q4, CrowdStrike, which is expected to increase its profitability, generated 93% of its revenues from subscription-based sales in the previous quarter. While an increase of more than 30% in subscription revenues is expected in the last quarter, it is likely to continue to contribute to the current revenue.

However, the upward trend in CrowdStrike’s operating expenses remains the biggest factor negatively affecting net income. Analyzing the fundamentals from the previous period, it is a remarkable development that the operating income, which wrote a loss, turned into a positive for the first time in the 3rd quarter at the level of 2.7 million dollars.

The fact that CrowdStrike, which has reduced the negative outlook in operating income in recent years, generated operating income in the last quarter can be considered an important clue for improvement in terms of financials.

Source: InvestingPro

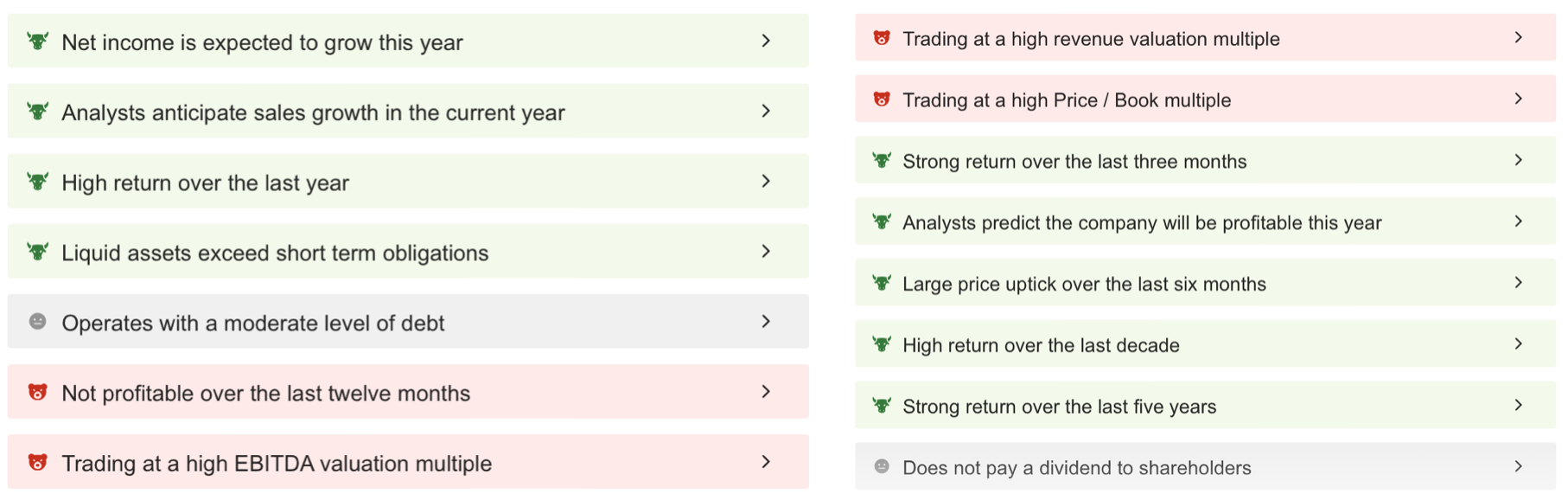

What Does ProTips Say?

The ProTips report on CrowdStrike’s financial outlook also contains important clues about the company.

Source: InvestingPro

If we summarize CrowdStrike’s strengths; sales growth and net profit growth expectations, the company’s high returns in the last year, and liquid assets remaining above short-term debt obligations. The company also has a positive long-term outlook.

On the other hand, the company’s weaknesses are the lack of profitability in the last 12 months, high valuation relative to income, and high P/B value. In addition, the fact that it continues at an average debt level in a high interest-rate environment and does not pay dividends can also be considered a warning sign.

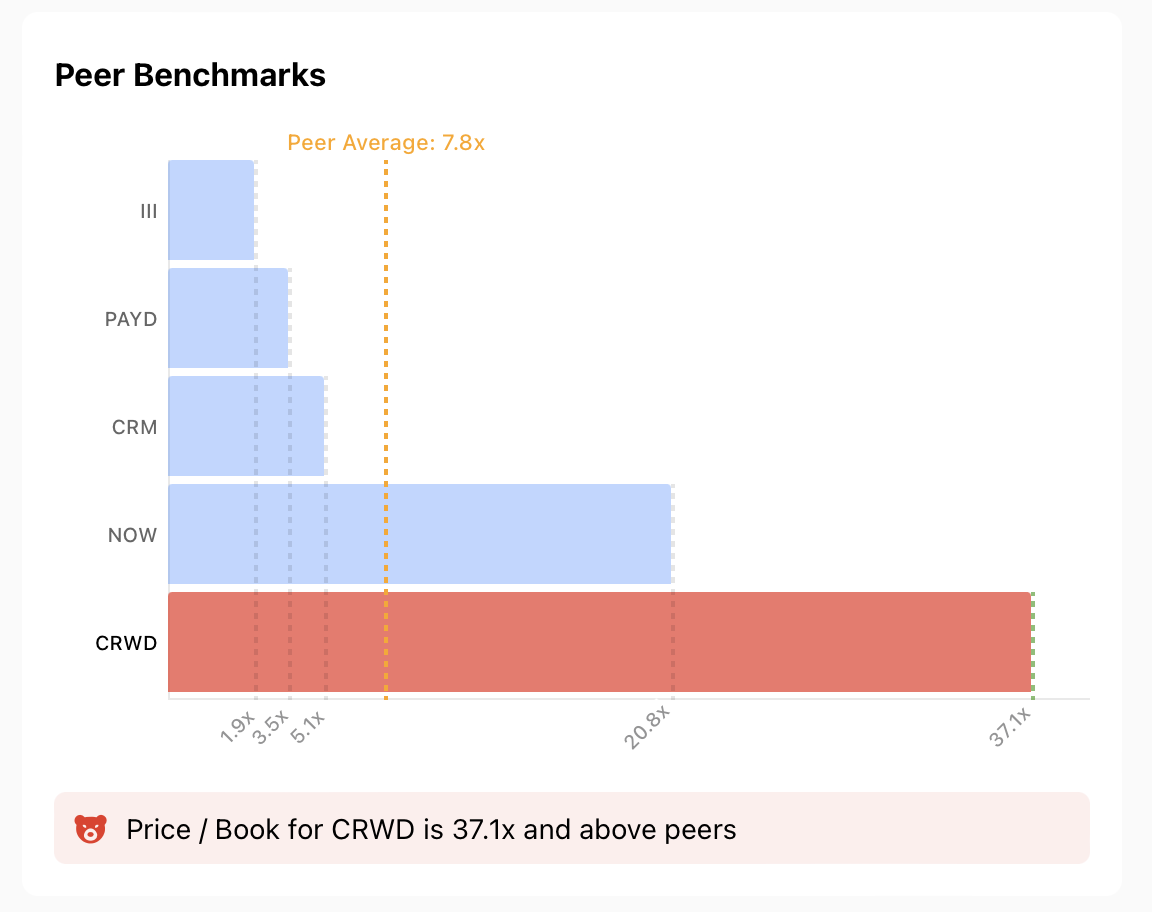

How Does CrowdStrike Fare in Comparison With Peers?

By comparing the company with peer companies in its sector, we can have more data on its current situation.

When we examine the performance and valuation indicator with peer companies, it is seen that CrowdStrike is in a better position in terms of revenue growth than Salesforce (NYSE:), which is about 4 times larger in terms of market capitalization.

In terms of gross profit margin, it is almost at the same level as its peers. This comparison is a particularly effective way to better understand whether a company’s stock is expensive or cheap. By the way, InvestingPro allows you to compare companies in the same industry based on many indicators.

Nvidia, which has achieved vertical growth momentum by leveraging AI in a significant way, is well ahead of CrowdStrike, with annual revenue growth of more than 125% and revenue growth of close to 40%. However, the potential for increased demand in the cybersecurity sector could have a very positive impact on CrowdStrike’s margins. Therefore, the Q4 financials that the company will announce after the close today may be indicative of this potential growth.

In terms of price performance, CRWD has risen nearly 150% in the last year, well above the S&P, which has risen 26%. This shows that investors’ demand for CrowdStrike, which stands out with its artificial intelligence-supported products and services, is quite high.

Source: InvestingPro

From this point of view, despite the company’s P/B ratio of 37x, we can mention that investors do not pay much attention to this correction-signaling ratio, relying on its bullish potential.

The overall health of the company and the stock’s price momentum are in very good condition, while financial health can improve if profitability and cash flow situation improve.

Source: InvestingPro

CrowdStrike: Technical View

Looking at CRWD from a technical perspective, it is seen that the stock, which recorded a healthy uptrend throughout 2023, continued its current trend in 2024. CRWD, which broke its last peak in the first days of the year, has not been able to break the Fib 1,272 value of $330 since February.

The stock, which has been moving in the resistance zone for the last month, may face another wave of demand as seen in other quarters if positive financial results are announced today and may move towards the next resistance zone at $ 390 above $ 330. While this region is an important resistance area for CRWD, the breakout could trigger the trend to move toward the $ 500 region.

If a correction comes at this point, it will be followed as the closest support point at $ 280. Below this support, a correction towards $ 240 seems likely.

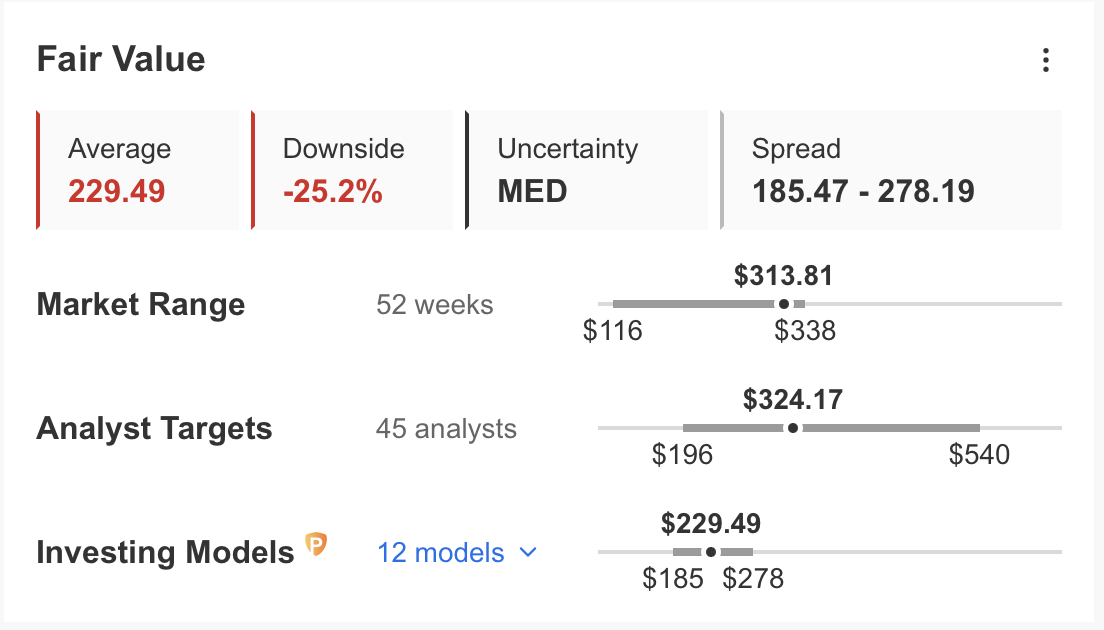

InvestingPro fair value analysis, on the other hand, predicts that according to the latest financial outlook, the stock could fall 25% for the year and retreat to $230.

***

Take your investing game to the next level in 2024 with ProPicks

Institutions and billionaire investors worldwide are already well ahead of the game when it comes to AI-powered investing, extensively using, customizing, and developing it to bulk up their returns and minimize losses.

Now, InvestingPro users can do just the same from the comfort of their own homes with our new flagship AI-powered stock-picking tool: ProPicks.

With our six strategies, including the flagship “Tech Titans,” which outperformed the market by a lofty 1,745% over the last decade, investors have the best selection of stocks in the market at the tip of their fingers every month.

Subscribe here and never miss a bull market again!

Don’t forget your free gift! Use coupon code INVPROGA24 at checkout for a 10% discount on all InvestingPro plans.

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple points of view and is highly risky and therefore, any investment decision and the associated risk remains with the investor.