Wall Street’s three major indexes tumbled on Friday to notch their worst week in more than a year as hot inflation data and mounting geopolitical tensions in the Middle East dented investor sentiment.

For the week, the blue-chip sank 2.4% in its biggest weekly percentage loss since March 2023. Meanwhile, the benchmark and the tech-heavy declined 1.6% and 0.5% respectively.

Source: Investing.com

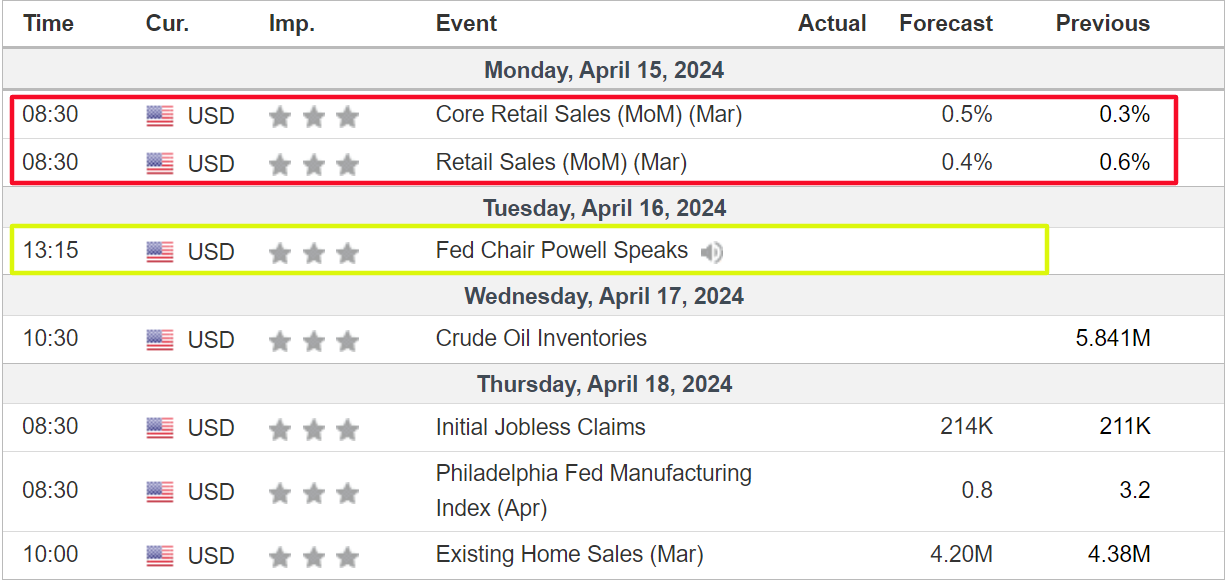

The week ahead is expected to be another busy one as investors continue to gauge the outlook for the economy, inflation, and interest rates.

On the economic calendar, most important on the economic calendar will be Monday’s U.S. retail sales report for March, with economists estimating a headline increase of +0.4% after sales rose +0.6% during the prior month.

In addition, Fed Chairman Jerome Powell will participate in a fireside chat about economic trends in North America at the Wilson Center’s Washington Forum, in Washington DC, on Tuesday afternoon.

Source: Investing.com

Traders now see about a 77% chance of the first rate cut hitting in September, according to the Investing.com .

Meanwhile, the first quarter earnings season shifts into high gear, with reports this week expected from notable names like Netflix (NASDAQ:), Taiwan Semiconductor (NYSE:), ASML (NASDAQ:), Bank of America (NYSE:), Goldman Sachs (NYSE:), Morgan Stanley (NYSE:), Johnson & Johnson (NYSE:), Procter & Gamble (NYSE:), and UnitedHealth Group (NYSE:).

Elsewhere, investors will monitor fresh developments in the Middle East following Iran’s unprecedented attack on Israeli territory over the weekend, which raised the prospect of a much-bigger regional conflict.

Regardless of which direction the market goes, below I highlight one stock likely to be in demand and another which could see fresh downside. Remember though, my timeframe is just for the week ahead, Monday, April 15 – Friday, April 19.

Stock To Buy: Netflix

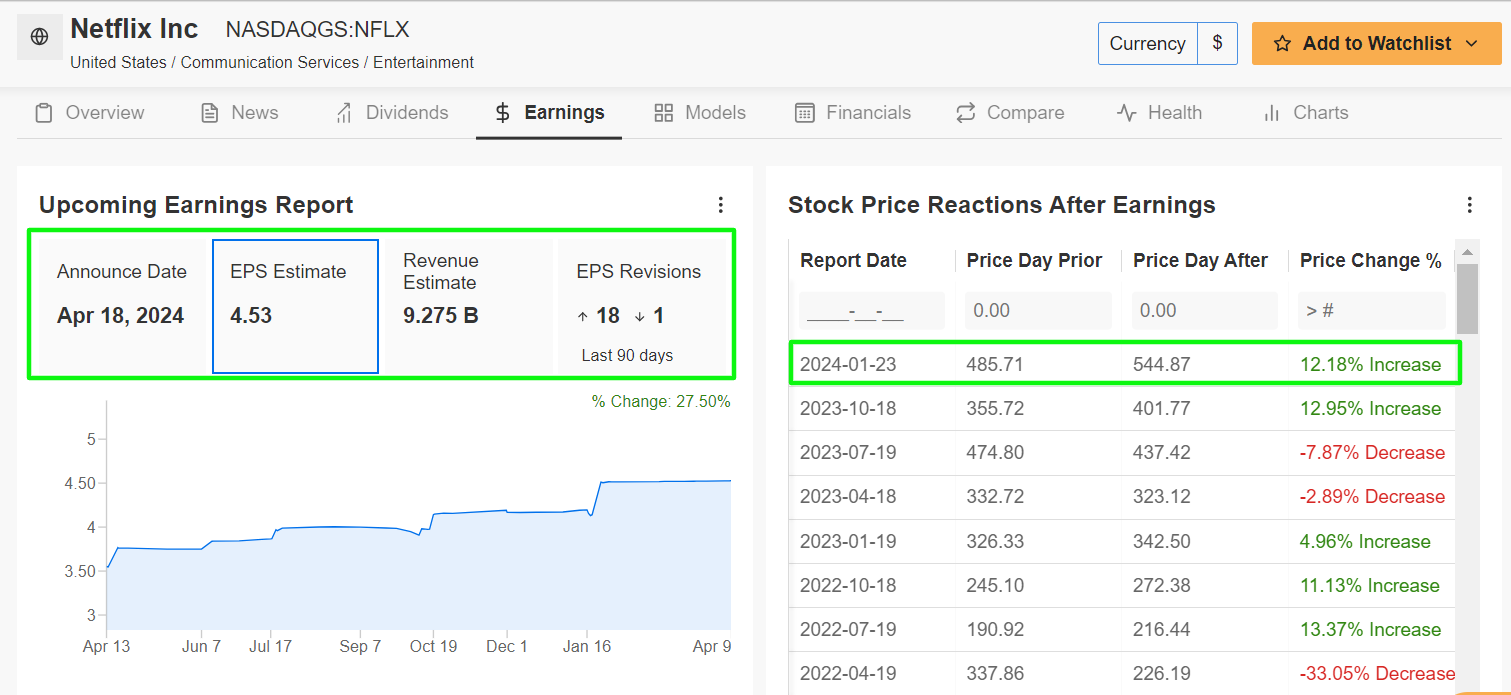

I expect Netflix (NASDAQ:) to outperform this week, possibly culminating in a breakout and a push towards new record highs, following the release of the streaming giant’s first quarter earnings report.

Netflix is slated to release its Q1 update after the U.S. market closes on Thursday at 4:00PM ET, and results will once again surprise to the upside in my view thanks to favorable consumer demand trends and an improving fundamental outlook.

Market participants expect a sizable swing in NFLX stock after the numbers drop, as per the options market, with a possible implied move of about 9% in either direction. Notably, shares soared roughly 12% after the streaming company’s last earnings report in January.

It is worth mentioning that profit estimates have been revised upward 18 times in the past 90 days, according to an InvestingPro survey, compared to just one downward revision, as Wall Street grows increasingly bullish on the Internet television network.

Source: InvestingPro

Netflix is seen earning $4.53 per share for the first quarter, jumping approximately 58% from EPS of $2.88 in the year-ago period, amid the positive impact of ongoing cost-cutting measures.

Meanwhile, revenue is forecast to increase 13.6% year-over-year to $9.27 billion, as the streaming video leader benefits from its low-cost basic subscription tier and amid intensifying efforts to crack down on illegal password-sharing.

If that is in fact confirmed, it would mark the highest quarterly sales total in Netflix’s 27-year history, as more people sign up for its video streaming services amid the current environment.

As such, I reckon Netflix will maintain its rapid pace of net streaming subscriber additions and easily top Wall Street estimates of about 4.8 million new global subscribers added during the March quarter.

The streaming giant ended 2023 with 260.28 million subscribers worldwide. Subscriber growth has been fueled, in part, by the company’s ongoing crackdown on shared passwords that started last year.

NFLX stock ended Friday’s session at $622.83, not far from its November 2021 all-time high of $688. At current levels, the Los Gatos, California-based company has a market cap of $269.5 billion.

Source: Investing.com

Shares are up 27.9% through the first four months of 2024, following a 65% rally in 2023.

InvestingPro’s ProTips underscore Netflix’s promising outlook, emphasizing its favorable positioning in the streaming industry, which has allowed it to leverage a resilient business model and strong profit growth.

Stock to Sell: Morgan Stanley

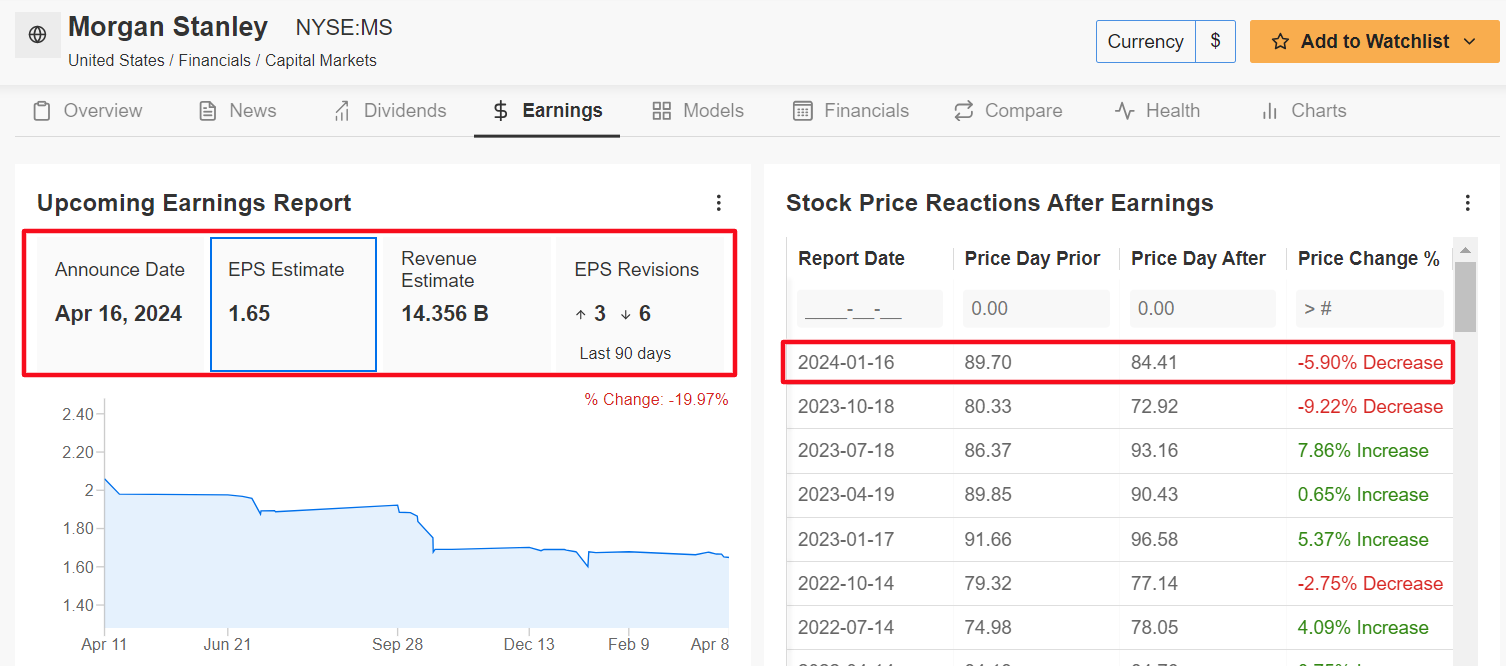

I foresee a weak performance for Morgan Stanley (NYSE:) in the week ahead, as the investment banking giant’s first quarter update will probably underwhelm investors amid a weak performance across its key business segments.

Morgan Stanley’s Q1 financial results are scheduled to come out before the opening bell on Tuesday at 7:30AM ET and are likely to take a hit from a significant slowdown in both its key investment banking unit and wealth management services business.

Options trading implies a roughly 5% swing for shares after the update drops. MS stock sank almost 6% after the company’s fourth-quarter report came out in mid-January.

Underscoring several headwinds Morgan Stanley faces amid the current backdrop, an InvestingPro survey of analyst earnings revisions points to growing pessimism ahead of the report, with six out of nine analysts slashing their estimates for both EPS and profit growth in the past 90 days.

Source: InvestingPro

Consensus calls for the New York-based financial services firm to report earnings per share of $1.65 for the first three months of 2024, falling 3% from a profit of $1.70 a share in the year-ago period.

To make matters worse, revenue is forecast to decline 1% annually to $14.35 billion amid a disappointing performance in its all-important wealth management and investment banking divisions.

As such, I believe Morgan Stanley CEO Ted Pick will show caution about forecasting net income growth for the coming months as the bank struggles amid a mixed business environment.

MS stock closed at $86.27 on Friday, earning the Wall Street giant a valuation of $140.2 billion.

Source: Investing.com

Shares have gotten off to a downbeat start in 2024, falling 7.5% year-to-date, amid mounting regulatory concerns.

It should be noted that Morgan Stanley currently has a below average InvestingPro ‘Financial Health’ score of 2.2 out of 5.0 due to concerns about profit growth prospects, and free cash flow levels.

Be sure to check out InvestingPro to stay in sync with the market trend and what it means for your trading.

Readers of this article enjoy an extra 10% discount on the yearly and bi-yearly plans with the coupon codes PROTIPS2024 (yearly) and PROTIPS20242 (bi-yearly).

Subscribe here and never miss a bull market again!

Disclosure: At the time of writing, I am long on the S&P 500, and the via the SPDR S&P 500 ETF (SPY), and the Invesco QQQ Trust ETF (QQQ). I am also long on the Technology Select Sector SPDR ETF (NYSE:).

I regularly rebalance my portfolio of individual stocks and ETFs based on ongoing risk assessment of both the macroeconomic environment and companies’ financials.

The views discussed in this article are solely the opinion of the author and should not be taken as investment advice.